Payroll Services

Streamline Your Finances with Accurate and Reliable Support

Payroll Services

Managing payroll can be a complex and time-consuming task for any business. JoD Tax offers comprehensive Payroll Services designed to make payroll processing seamless, efficient, and compliant with all federal and state regulations. Based in Texas, our experienced team provides customized payroll solutions for businesses of all sizes, ensuring that your employees are paid accurately and on time while you remain focused on running your business, giving you a sense of relief and stress-free operation.

JoD Tax handles the intricacies of payroll management, including tax withholdings, employee benefits, and compliance with employment laws. We use advanced systems and technology to streamline payroll processing, ensuring timely payments and accurate reporting while staying current with ever-changing tax laws.

- +1 469 782 4423

- info@jodtax.com

Our Payroll Services Include

- Payroll Processing

- Tax Withholding & Filing

- Direct Deposit & Check Printing

- Employee Benefits Administration

- Payroll Compliance

- New Hire Reporting

- Payroll Tax Audits & Representation

- Time Tracking & Attendance

Benefits of Using JoD Tax for Payroll Services

Efficient, Accurate, and Hassle-Free Payroll Management

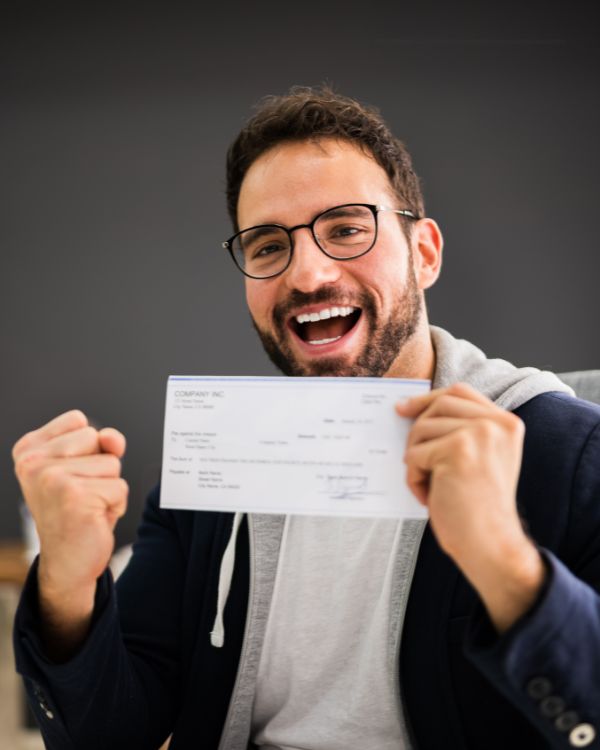

Our Happy Clients!